I regret not getting into investments sooner, and I'm not alone. It turns out 77% Americans regret not investing earlier in their lives, according to a nationwide survey. As a young doctor, I just didn’t think about it all that much. But now that I’ve advanced in my career and have a young family, I take investing in our future very seriously.

That’s why I give lectures to Weill Cornell medical students, residents, and fellows about the importance of investing early. Don’t be afraid to invest, I tell them, so long as you’ve done your research, because early investing is key to long-term success and security. But with the stock and crypto market looking shaky, I wanted to diversify my portfolio and try to reduce my risk exposure for the long run. So I did some digging for ways to diversify and found something incredible.

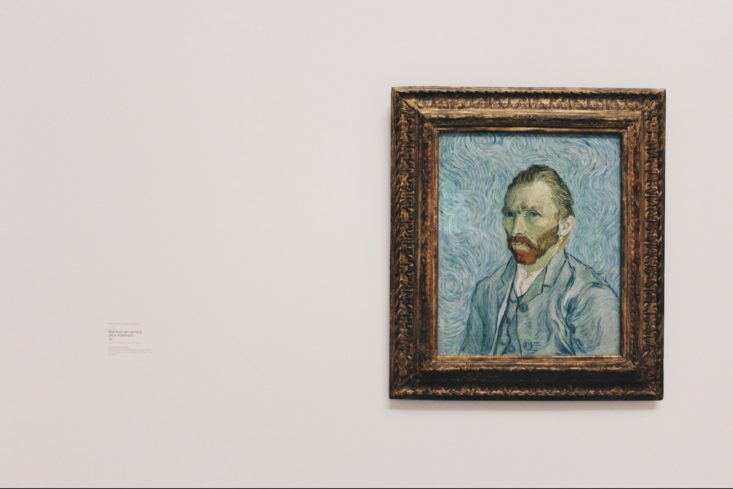

Masterworks is the first fintech platform for investing in art. Instead of buying whole art pieces, you’re investing in shares of those works. And by art, I don’t mean paintings you can find at your neighbor's garage sale.

I’m talking about art by legends like Picasso, Monet and Warhol. You know pieces worth hundreds of millions of dollars or even tens of millions just like ones that you find in museums.

I was intrigued. At the time, I was looking for new investment opportunities that offer growth potential while diversifying my portfolio. It turns out billionaires usually allocate 10-30% of their portfolios to art, according to Deloitte. What’s more, big names like Jeff Bezos, Bill Gates and even Oprah all invest millions into art. And I thought to myself, “there’s probably a reason for that.”

Outside of my curiosity, I was impressed with Masterworks. Since 2018, they have acquired over 120 blue-chip artworks and their members have invested over $500 million with them. Their three highly successful exits have netted annual returns of more than 30% each**. The price appreciation of those three paintings even beat the average performance of the S&P over the last 25 years. (In fact, contemporary art prices have outperformed the S&P 500 over the past 25 years.)

An Inside Look at Masterworks

Thanks to this success, Masterworks now boasts over 450,000 members , all with access to the art market. And with inflation running at a 40-year high, investing in art – historically a hedge against inflation – could be even more appealing right now. Contemporary art prices appreciated by 23% annually during times of high inflation aka right now.

After their industry-leading research team identifies the artists who are currently gaining momentum in the market, Masterworks acquires works by them that they believe have a chance of appreciating. These artworks are securitized and then offered exclusively to members . Once they do that, you can invest in shares of those paintings.

Masterworks has compiled what they believe to be the most complete database of paintings that have been purchased and resold. They literally have over 5,000,000 datapoints analyzed. As a matter of fact, firms like Citibank even use their data in their art market reports. And their team is pretty picky when it comes to what they buy. They’ve been offered over $10 billion worth of art and less than 5% met their criteria.

Specialized Research to Guide Investors

Masterworks encourages investors to research, track, and evaluate how art performs using their database. Being an art expert is not a prerequisite to invest. According to them, 99% of their investors had no art investing experience before investing..

They offer support from a team of advisors, who can discuss current offerings and provide information to help tailor an art portfolio to your risk profile. I received a lot of useful guidance after speaking with one of their advisors – it was not at all like a sales call. They got to know me as a person and made sure this investment aligned with my financial goals.

Masterworks targets holding artworks for between 3-10 years, after which investors receive any pro rata proceeds if the painting’s price appreciates when it sells. Masterworks also has a Secondary Market that allows investors to independently buy and sell shares. It's the first online platform to enable the buying and selling of art investments.

Looking Ahead: Diversifying Into the Art Market

My ultimate goal is to have between 3%-5% of my portfolio in what I’d consider “unconventional” investments — markets that are interesting to me and still offer potential returns but are a little “off the beaten track” for most investors. Masterworks offers me an excellent avenue to achieve that diversification, without the need for a large investment up front.

It’s kind of cool to be part of the art world, even in a small way. For me personally, it makes sense to diversify into securitized artworks by big-name artists — all part of a global market that can provide very good medium- for my long-term investment strategy. to long-term returns. I like that I retain the option to sell on the Secondary Market if or when I need to.

Even as a busy doctor and educator, I can now be part of this exclusive market. With Masterworks, anyone with disposable income looking for diversification — even if you don’t know about art right now— can get into an exciting space. And I have to say, it’s pretty cool that I invest in a piece of a Picasso and a Ruscha!

Masterworks has a product that could still be attractive in our current economic situation. It offers diversification and potential protection from inflation. There’s still demand for this type of investment, so I’ve teamed up with Masterworks and scored you all priority access to their platform. All you have to do is click my exclusive xxx referral link

See important Regulation A disclosures at masterworks.io/cd.

*Since inception, Masterworks has sold only three paintings from its collection. These sales are not an indication of Masterworks’ overall performance. Past performance is not indicative of future results. The sale of paintings from the Masterworks collection is at the sole discretion of Masterworks and paintings may be held for up to 10 years or longer.