I love art. It connects me to so many special times and places in my life: visiting the Louvre on my first visit to Paris, a sculpture my grandparents bought me for my graduation and seeing the statue of David in Florence while on a trip to Italy with friends. Art has always been a big part of my life, but now I have a chance to make it a part of my investing strategy.

Like many people, I’ve long thought an investment portfolio could only be composed of stocks, bonds, and real estate. But now top firms like Citi Bank, Morgan Stanley, and Deloitte believe art might have a place in portfolios too.

Blue-chip art prices have outpaced the S&P 500 index by 164% as of the last twenty-five years ending June 2021. And demand for art is so high, that the Wall Street Journal said art is “among the hottest markets on earth”.

But there’s always been one key problem…

The biggest names in art are often out of reach for the average investor. (And let’s be honest, the chances of stumbling across a Picasso at a garage sale are pretty slim.)

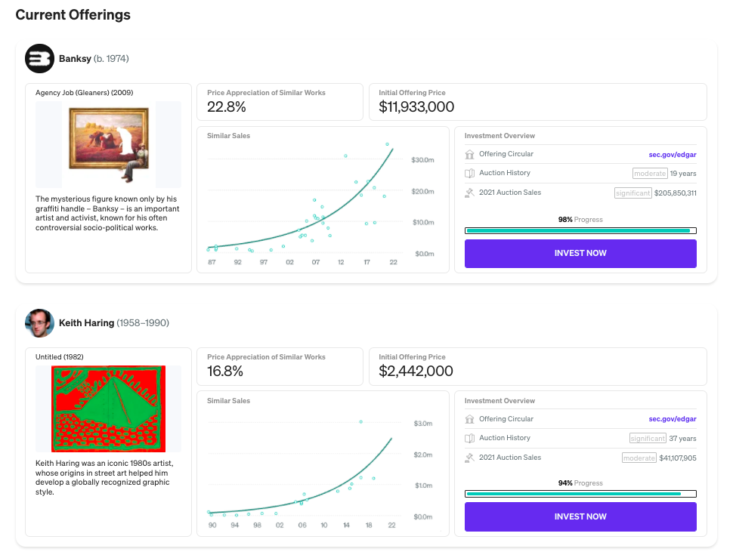

Thankfully, Masterworks makes the art world more accessible than ever before by offering investors the opportunity to invest in a part of some of the most exclusive artworks in the world — without the high costs, and hassle of buying entire works of art themselves.

Launched in 2017, and based in New York City — — Masterworks’ mission is to open up opportunities to fractionally invest in art.

Investing in rare art used to be far more difficult than more ordinary equities like stocks and bonds. But that’s not the case at all. Masterworks handles the entire process of finding, purchasing, and safely storing valuable works of art in a climate-controlled secure environment.

Their platform is so easy to use, with a dedicated art membership rep to answer questions.

As one of the largest buyers in the global art market, Masterworks has the purchasing power to secure prized works of art by the most recognized names, like Banksy, Jean-Michel Basquiat, Andy Warhol, Picasso, Claude Monet, and many more. The Masterworks research team determines which artists and artworks have the most momentum, taking into consideration factors such as artists’ global collector bases, trends in demand for their work, and historical appreciation rate.

Masterworks aims to hold pieces for three to ten years, at which point the painting will be sold and potential proceeds from that sale distributed among investors. However, their secondary market could provide members with some liquidity. This means you can buy and sell shares directly to and from other investors — with zero transaction fees.

I will always love art for art’s own sake. But, let’s face it, art has also been an investment, too. I may not think of my Picasso shares the same way I think about the painting my husband and I purchased when we visited Cuba, but I appreciate both.

See important Regulation A disclosures at masterworks.io/cd

Diversification and asset allocation do not ensure profit or guarantee against loss. There are significant differences between art and other asset classes. Investing involves risk, including loss of principal.