I work with a lot of solopreneurs (freelancers, contractors, real estate agents etc.) and the most common question I get asked is “how do I save the most on taxes?” Like most things in business, the answer is “it depends”. Not everything is a write-off (thanks Schitt’s Creek) and I don’t recommend buying a G-Wagon, no matter what the TikToks tell you.

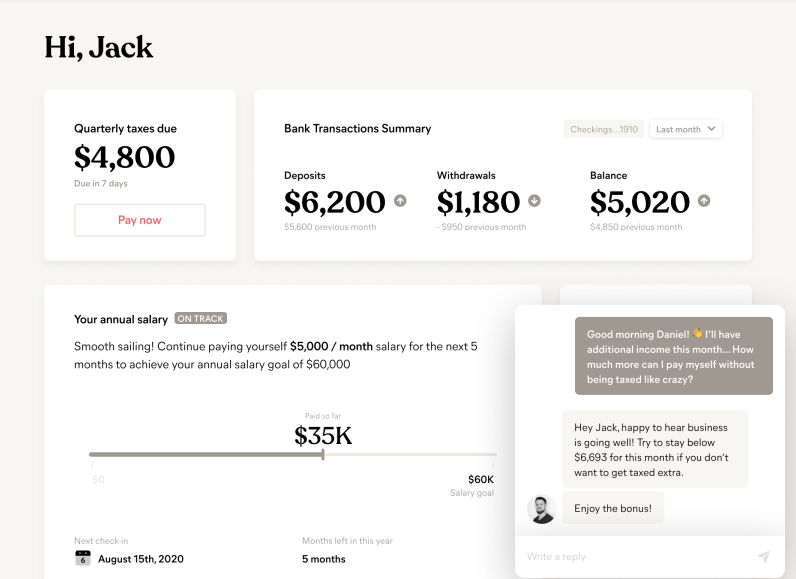

However, knowing the difference between LLCs and S Corps can result in huge savings. Like $10,000 huge, which is how much the average member of Collective, an online back office platform built exclusively for solopreneurs, saved on taxes in 2022. So, let’s dive into the details a bit more.

When is an S Corp right for you?

Considering the extra cost to start and manage an S Corp, along with compliance and payroll processing, the aforementioned tax savings start to kick in once you’re earning over $60,000 per year. When you’re ready to take that next step, Collective makes it easy for you to get started.

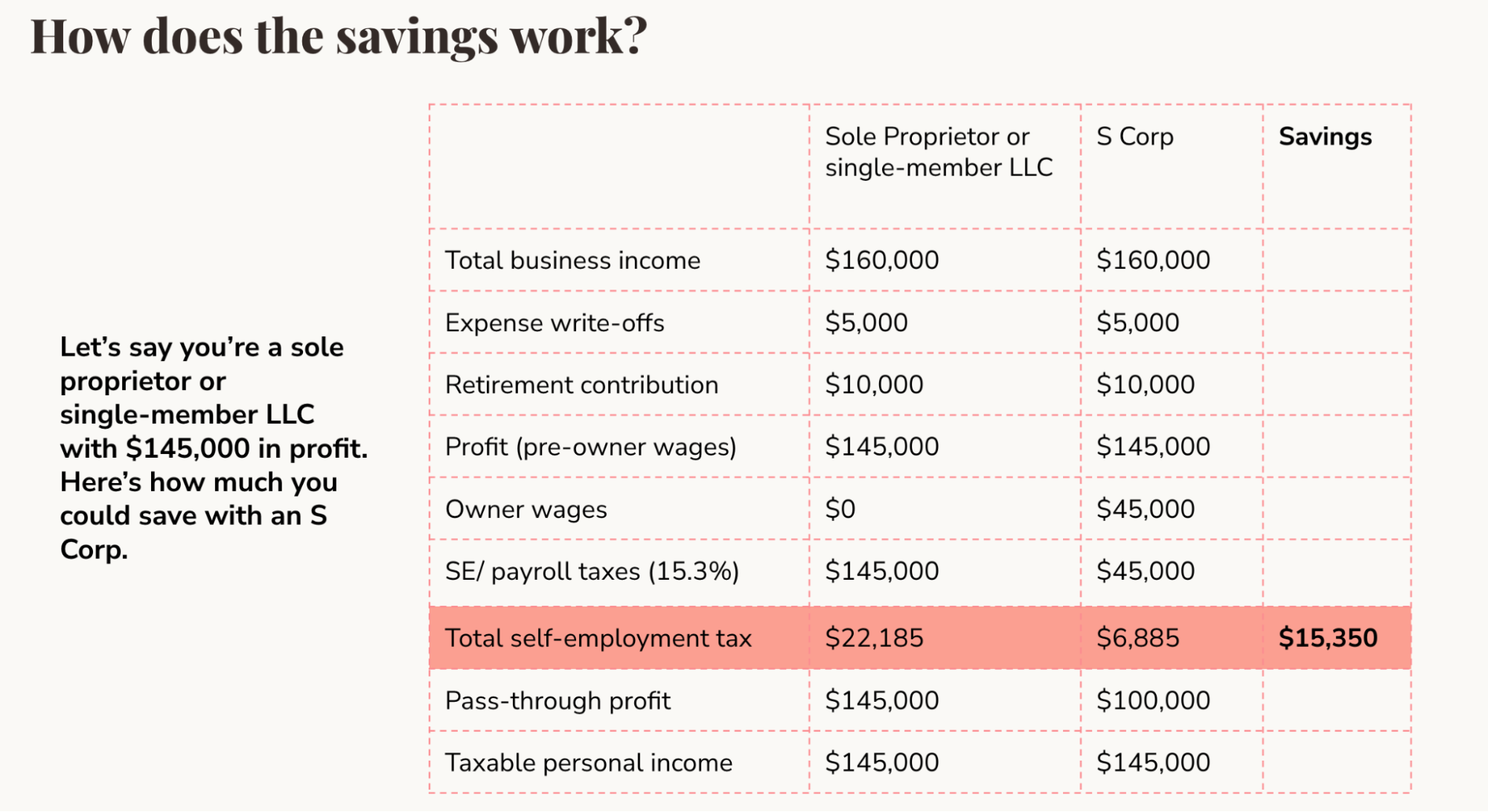

Here’s an example to see how much an S Corp can save you:

At $145,000 in profit, that results in savings of $15,350!

Mind you, the salary has to be reasonable and the IRS keeps an eye on it. There’s no clear documentation on this, but Collective provides guidance on reasonable salary for your specific situation (another benefit).

What is an LLC or S Corp?

When doing business by yourself you automatically take the designation of Sole Proprietor and your revenue and expenses are added to your Schedule C on your taxes. This can be a great solution for side hustles and hobbies, but once things start to ramp up, creating a company can be incredibly beneficial.

The most common company type for solopreneurs is an LLC which is a business entity providing some legal protections to owners. Having a formed entity allows you to limit your personal liability in the event of legal trouble. Think about someone injuring themselves on your property or getting sued for a mistake. Despite these protections, I always recommend having proper business insurance as well.

An S Corp is a tax election - you’re basically telling the state and federal tax authorities how your profits should be taxed. You can be an LLC and be taxed as an LLC or taxed as an S Corp. Both of these are still considered “pass-through”, as in, the income passes through the company and onto your personal taxes.

In both of these structures, all profits are taxed as personal income. But with an S Corp, you get additional benefits.

Benefits of an S Corp

So how can an S Corp help? It all comes down to self-employment tax. Unlike an LLC, your earnings can be split between salary and profit. Only the salary portion is subject to self-employment tax while the profits are taxed as ordinary income only.

As an LLC, your full earnings (both guaranteed payments and profits) are subject to self-employment tax. At a rate of about 15.3%, you can see how reducing this tax can quickly add up to big savings.

Benefits of an LLC

Sometimes simpler is better. An LLC is really easy to maintain and generally costs less to establish. You also don’t have to worry about payroll processing or special compliance. This makes it ideal for lower-income work and side projects.

How to get started

I’m always trying to find ways for business owners to save money. If it’s a right fit, creating an S Corp is a no-brainer. There are a few self-service apps out there that can help with the setup and administration, but I’ve found myself consistently recommending Collective. They not only handle all the setup for an S Corp but also the bookkeeping, payroll, taxes, and compliance. You get all of these services for a very reasonable monthly fee of $299 (or $254 when paid annually). Of course, I still provide my expertise as needed!