Every year when tax season approaches, I cringe. When I became a solopreneur, I never expected just how complicated my taxes would become! Between making sure I had all of my business-related expenses and income tracked, plus understanding all the tax deductions I qualify for, it all was incredibly stressful.

I knew there had to be a better way to handle taxes as a solopreneur, so I started researching my options. I came across Collective, a solution for self-employed business owners, and here's how it compares to doing your taxes yourself.

If you want to save the most...Collective

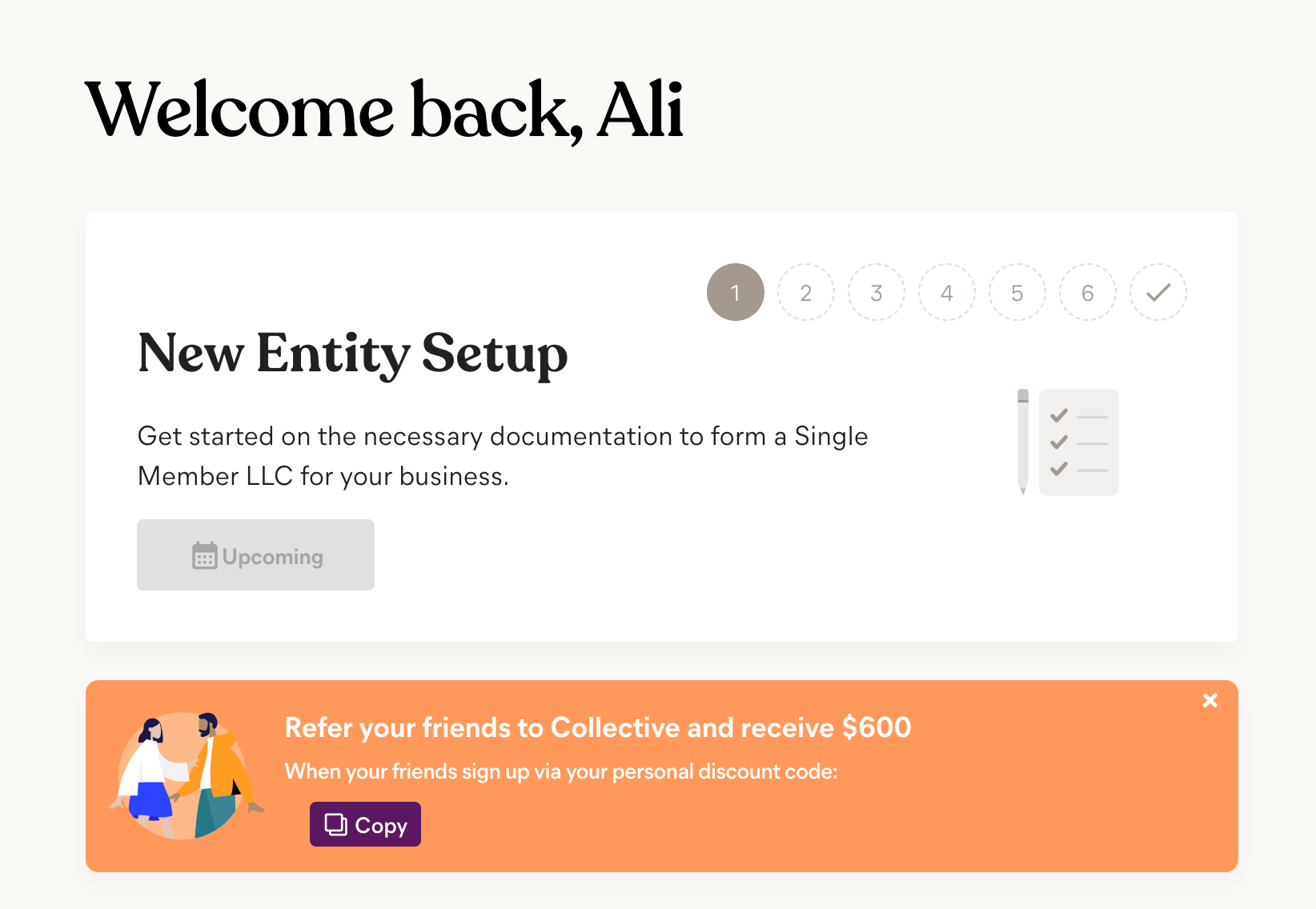

Collective saved me a lot of time and money. First, they had an easy-to-use platform that made filing my taxes simple. I was able to easily upload all of my past tax documents, business expenses, income, and deductions in one place for easy viewing. Plus, Collective took all the guesswork out of tax filing by providing tailored advice based on my unique situation.

If I had any questions at all, their advisors were always available. It was also so convenient to be able to meet my advisor virtually, from the comfort of my own home!

Most importantly, Collective works to maximize my deductions and calculate potential tax savings so I save the most money possible. This ended up saving me hundreds of dollars on my taxes compared to when I did them myself!

If you’re already a CPA…Do It Yourself

If you’re already a CPA, you might not take any issue with doing your taxes yourself–after all, you are the expert. But for those of us who aren’t accountants, Collective’s time and money-saving solution is a lifesaver.

If you want comprehensive services...Collective

Being a solopreneur is complicated, and I quickly learned that boxed software wouldn't be able to handle the complexities of my taxes. Collective is designed specifically for small business owners and freelancers, which means they understand all the nuances that come with filing taxes as a sole proprietor.

Along with taxes, Collective can help with S Corp formation, compliance, payroll, bookkeeping, and accounting services. On top of that, Collective helped me maximize my deductions and reduce my tax bill by asking questions I wouldn’t have considered on my own.

If you want a stress-free tax season...Collective

Collective is an all-in-one tax solution that not only prepares my taxes for me, but also handles all the filing requirements—which takes a lot of stress out of tax season.

All I have to do is input my information, and they handle the rest! Knowing I have a full tax team on my side has made a world of difference, and I don’t have to pay for bookkeeping and payroll services separately – it’s all included with Collective’s platform.

If you want to save time...Collective

Dealing with taxes is time-consuming enough – let alone if you're filing them yourself. Collective makes the process so much faster and easier for me.

I no longer have to worry about spending hours researching deductions or trying to figure out how to fill out forms correctly. They handle everything from start to finish, and their advisors are always just a virtual meeting away if I ever have any questions.

The Verdict

My experience with Collective has been nothing short of amazing. They have enabled me to save time and money while providing a stress-free tax season. So if you are a solopreneur and want to maximize your deductions and reduce your tax bill, I highly recommend Collective!