If you’re struggling with low credit, you’ve probably noticed that the financial world isn’t exactly on your side. You’re often stuck with high-cost options, like loans with extreme interest rates, limited access to housing, and even difficulties securing certain jobs. Predatory lenders take advantage of this, offering high-interest loans—sometimes in the triple digits—and unfavorable terms that borrowers with limited options may feel pressured to accept.

But how do you spot a predatory lender in the first place? Along with excessive fees and sky-high interest rates, be wary of:

- Pushy sales tactics

- Frequent calls or emails

- Unannounced visitis

- Incomplete or confusing loan terms

Legitimate lenders don’t need to pressure you. Beware of prepayment penalties, a major red flag that a lender wants to keep you tied to debt longer.

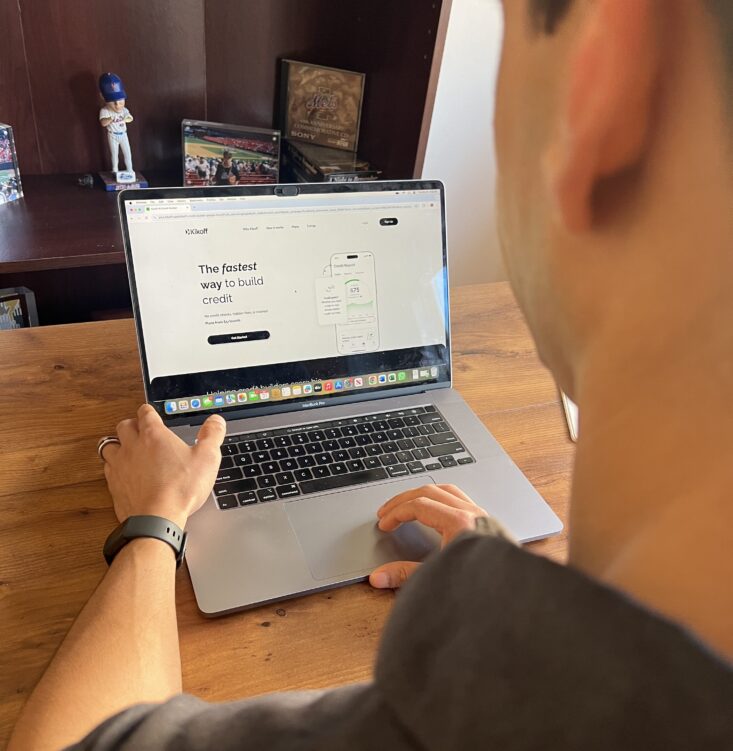

So, how do you avoid this trap? For me, the answer was Kikoff—a credit-building app that’s made it possible to grow my credit affordably and safely, without the risks of predatory lenders. Here’s how:

1. Get Set Up Quickly Without Credit Checks

When I started my credit journey, I didn’t have much of a credit history to speak of, which meant that every credit option felt impossible to access. But Kikoff doesn’t require a credit check to get started. With the Basic Plan at just $5/month, I could set everything up in minutes.

No endless forms or complicated verifications. It’s the perfect way to build credit from scratch without having to worry about hidden fees or shady contracts.

2. Consistent Credit-Building with Minimal Effort

With Kikoff’s Basic Plan, you get a $750 tradeline that’s reported to the three major credit bureaus every month. Each time you make a payment, it’s logged as positive activity on your credit, and with consistency, your credit will start to improve.

This steady, reliable reporting helps strengthen your credit profile—reducing the risk of ever needing to turn to predatory lenders.

3. Faster Credit Growth with Kikoff Premium’s Extra Benefits

After seeing results with the Basic Plan, I upgraded to Kikoff Premium ($20/month), which was a huge step in my credit journey. With the Premium Plan, Kikoff reports a $2,500 credit line each month, giving your credit an even faster boost.

Plus, Premium includes rent reporting, so if you’re paying rent, those payments get counted too—no extra effort required.

4. Free Credit Monitoring to Keep You Safe

One of the most stressful parts of having low credit is not knowing where you stand or if you’re vulnerable to fraud. Both Kikoff’s Basic and Premium plans include free credit monitoring, which gives me peace of mind by keeping tabs on any unusual activity.

With Premium, I also get free 3-bureau credit reports and additional monitoring. Knowing I can check my credit report regularly and catch potential problems before they spiral out of control has been a huge relief, especially as someone working hard to avoid falling into debt traps.

5. Thousands of Success Stories—And Recognition from Top Finance Experts

Before committing to Kikoff, I checked out some reviews and saw that it’s backed by top finance experts like Credit Karma, NerdWallet, and CNBC, who all praise it as a smart, safe way to build credit.

With over 110,000 reviews and a 4.9-star rating on the App Store ⭐⭐⭐⭐⭐, Kikoff has helped thousands of people build their credit without ever needing to turn to predatory lenders. Seeing how much Kikoff has helped people in similar situations made me feel confident that I was making a sound decision.

Final Thoughts: Protect Yourself by Building Credit with Kikoff

If you’re working to build credit and want to stay clear of predatory lenders, Kikoff is an ideal choice. It’s simple, affordable, and gives you the control you need to grow your credit without taking on risky loans. Whether you start with the Basic Plan or go for Premium, you’re actively creating a future where you have better, fairer lending options.

Don’t let predatory lenders be your only choice—choose Kikoff, and build your credit on your own terms!