These days, it feels like regular banks are built for everybody but working people. You wait days for your paycheck to hit, get slammed with overdraft fees when life happens, and spend way too much time on the phone begging them to reverse charges.

I’m juggling school full-time as an electrician apprentice, plus long shifts as an avionics tech, and I don’t have any time or money to waste at a traditional bank. That’s why I moved over to Current, and honestly, I wish I’d done it sooner.

What is Current¹?

Current isn’t just “another finance app.” It’s a financial technology company designed for people who work regular jobs, get paid on a schedule, and need flexibility in how they access their money. Unlike a traditional bank, Current is built around solving the real problems we run into: bills that don’t wait until payday, random charges that push your account into the red, and the stress of making ends meet between checks.

Here’s what sets it apart: Current gives you access to features like Paycheck Advance² and Fee-Free Overdraft³ once you qualify, which put money back in your pocket when you actually need it.

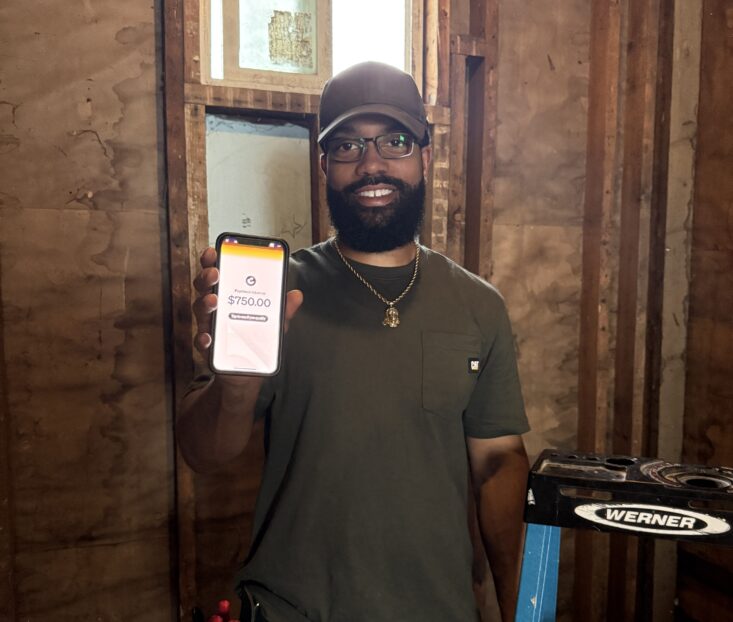

Feature #1: Paycheck Advance (Get Up to $750²)

For me, this one’s been huge. As an electrician apprentice, I get paid every other Friday, but life doesn’t always line up with payday. Before Current, if my truck broke down on a Wednesday, I’d either put the repair on a credit card or cross my fingers until payday. With Current, I qualified for up-front access to part of my paycheck (up to $750²) without a credit check.

Here’s how it works:

- Open a Current account (it literally took me 3 minutes on my lunch break).

- Set up an eligible payroll deposit.

- Once that’s flowing, you can see if you qualify for Paycheck Advance².

It’s not a loan; it’s your money, just earlier. I used mine to cover my electric bill before the late fee hit and still had enough to stock up on groceries before the weekend. That kind of breathing room makes a huge difference.

Feature #2: Fee-Free Overdraft (Up to $200 for New Users³)

We’ve all been there: your account dips lower than expected because of a surprise charge, and suddenly your bank slaps you with a $35 overdraft fee (sometimes more than once in a day). That used to wreck me. With Current, as a new user, I qualified for up to $200 in Fee-Free Overdraft³ just by setting up an eligible payroll deposit.

A couple weeks ago, I was about $60 short before payday. Normally, I’d be sweating bullets or scrambling to cover it. Instead, Current spotted me. No overdraft fee, no hassle, just a safety net. I paid it back when my direct deposit hit. That’s it.

It’s the kind of feature that keeps you moving forward instead of digging you into a hole.

Why Current > Your Old Bank

I used to stick with my old bank just out of habit. Honestly, I didn’t even like it; I just thought switching would be complicated. Turns out, it wasn’t. Current gave me more control over my money right away. Between Paycheck Advance² and Fee-Free Overdraft³, it’s like having a financial tool that actually adapts to how I live and work.

And here’s the kicker: I’ve tried other apps, but none of them gave me both the breathing room on overdrafts and early access to my paycheck in one place. Current makes it simple without any gimmicks or hidden strings attached.

Final Thoughts

As someone working two jobs while grinding through trade school, I don’t need a “fancy bank.” I need something that helps me handle real-world stuff without making it harder. With Current, I finally feel like I’m not fighting against my bank anymore. It gives me access to what I’ve already earned, and it helps me avoid the unnecessary fees that traditional banks thrive on.

For anyone who’s tired of late fees, overdraft charges, or just waiting around for payday, I’d say: try Current. It’s a financial reset button that actually works for people like us.

Disclaimers

¹ Current is a financial technology company, not an FDIC-insured bank. FDIC insurance up to $250,000 only covers the failure of an FDIC-insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. Banking services provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC. The Current Visa® Debit Card is issued by Choice Financial Group pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. The Current Visa® secured charge card is issued by Cross River Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see the back of your Card for its issuing bank. Current Individual Account required to apply for the Current Visa® secured charge card. Independent approval required.

² For eligible customers only. Your actual available Paycheck Advance amount will be displayed to you in the mobile app and may change from time to time. Conditions and eligibility may vary and are subject to change at any time, at the sole discretion of Finco Advance LLC, which offers this optional feature. Finco Advance LLC is a financial technology company, not a bank. For more information, please refer to https://current.com/docs/paycheck_advance_terms/.

³ Up to $200 overdraft amount only available for a limited time to new users who sign up for a Current account through the applicable landing page and/or with the applicable code, as determined by Current in its sole discretion. Actual overdraft amount may vary and is subject to change at any time, at Current’s sole discretion. In order to qualify and enroll in the Fee-Free Overdraft feature, you must receive a minimum of $200 or more in Eligible Direct Deposits into your Current Account over the preceding 35-day period and fulfill other requirements subject to Current’s discretion. Negative balances must be repaid within 60 days of the first Eligible Transaction that caused the negative balance. For more information, please refer to https://current.com/overdraft_protection_terms_of_service/.