Inflation is a hot button issue right now. It’s a conversation topic on the cable network financial shows, and it seems to be dominating investing websites. As a former financial advisor, I know a thing or two about it, and I have a possible solution.

First of all, let’s head back into the classroom for a quick 101 on what inflation actually is. Inflation is the fancy word for money losing value due to economic conditions. That means, even though the numerical value of your portfolio might increase, rapid inflation could mean that it's still worth less than it was when you started.

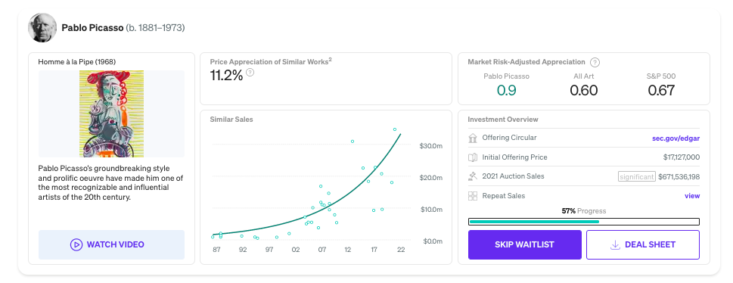

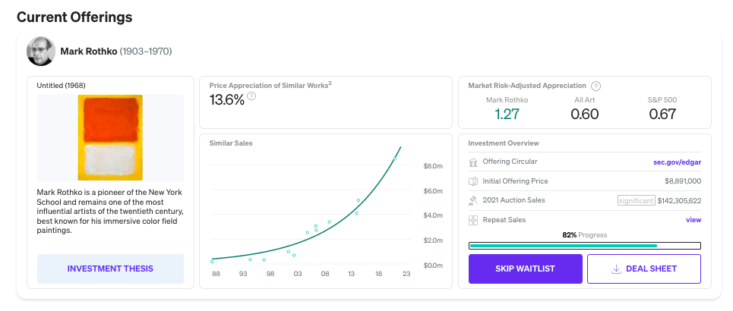

Fine art, in particular, is incredibly enticing because they’re tied to real world assets that hold their value better than stocks. Which sounds great in theory. But do you have millions of dollars to buy a Picasso? The thing is, now you don’t have to. Because of a revolutionary new investing platform called Masterworks.

Investing with Masterworks

Masterworks allows you to invest in shares of art, at a starting point that works for your investment goals, by securitizing multimillion-dollar works with the Securities and Exchange Commission. When the painting sells, you receive your portions of the potential profit.

They also have a Secondary Market for selling your shares to other investors, for when life demands it.

I can see the value of using art as an alternative financial investment (we use the word “instrument” in the biz).

Ok so that’s the technical “what”…the why is simple: diversifying a portfolio. If you invest in the stock market, you most likely invest in equities, stocks listed on exchanges like the NYSE or NASDAQ. You might also invest in some bonds to offset (or “hedge”) whatever potential losses may come from your equity holdings. If you’re new to markets, this is called a “hedge.” What Masterworks does is provide a different hedge that has very low correlation to the stock market—a hedge that could still work in a down market.

Inflation-Resilient Investment

Over the last 26 years (1995-2021), art has appreciated 13.8% annually. The S&P 500 has only grown 10.2% over the same period.* So there can be a great benefit to this if—and I really want to stress this—if it makes sense in your investing strategy. There are risks associated with art investing, and Masterworks doesn’t hide this. Mainly, the art you invest in might not sell for higher than your investment price. And if you try to sell your shares early, well, there might not be someone willing to pay what you did. That’s the rub.

To be able to invest with Masterworks, You will have to go through a phone interview, and they won’t let anyone over 70 invest (because these ARE long-term investments). Their website is extremely user-friendly, jammed with information about every one of the pieces available for investment, and their membership team is there to help determine your risk tolerance (a critical piece of investing!). I really liked this probably more than the art access because all too often I saw investors be taken advantage of in the past. This is not that situation at all.

Key Takeaway

Masterworks gives your average investor accessibility to a market they would otherwise not have access to and a potential hedge to a portfolio. Google Banksy, or the last art season at Sotheby’s, and you’ll see the art market is at a premium right now. The stock market? Not so much, and inflation might continue to increase. This is a great option to explore to hedge your traditional stock portfolio. Plus, who doesn’t want to be able to say they’re investing in a Picasso?

Disclosures: *While I’m not in the business anymore and my Series 7 and Series 66 license is no longer active, I’d be remiss to remind you that past performance does not guarantee future results. So please invest wisely. See important Regulation A disclosures at Masterworks.io/cd. This is a paid advertisement sponsored by Masterworks.