Ever since I opened my photography business and became a full-time solopreneur a few years ago, I knew that I wanted to partner with a professional who could help me manage bookkeeping, run payroll, file taxes, and navigate business structure planning. While I’m very good at the creative side and the day-to-day operations of my business, I found myself overwhelmed with the accounting and financial tasks that came with it.

So, I did what a lot of other business owners do: I interviewed multiple CPAs, and hired one. I soon realized how the costs of their services quickly add up - and that not all “financial partners” perform the same. After having my fair share of both good and not-so-good CPAs, I knew I needed an alternative. Then, I learned about Collective, an all-in-one financial solution for entrepreneurs like me.

Here’s how Collective compares with hiring a local CPA:

If you want an all-in-one solution…Collective

For me, the biggest factor that drew me to Collective was how it provided a one-stop-shop for all the services I needed - at one fixed price and in one platform.

Collective is an all-in-one financial solution that is designed for self-employed entrepreneurs like me! Its services include S Corp formation, compliance, payroll, tax, bookkeeping, and accounting services. This is unlike CPAs who often handle taxes, bookkeeping, and formation separately with different costs attached to each.

Once you sign up, you are paired with a team of experts that are available when you need them. You can reach your tax experts on demand, rather than waiting weeks for an appointment. Something I also love is that they treat all their members equally, which is quite unlike many CPAs who often focus their time on their highest-earning clients.

Its software also helps me calculate potential tax savings, and all members are paired with a Collective business advisor that provides even more tax-savings strategies.

If you value convenience…Collective

One of the main benefits offered by Collective is its convenience. All you need is an internet connection and you can log into their website at any time of the day or night.

Personally, I love Collective’s use of virtual meetings and online platforms because it allows me to engage with it and track my progress on any given project – all without leaving the comfort of your home or office. This feature has been incredibly helpful when I’m traveling for work and can’t make an in-person appointment.

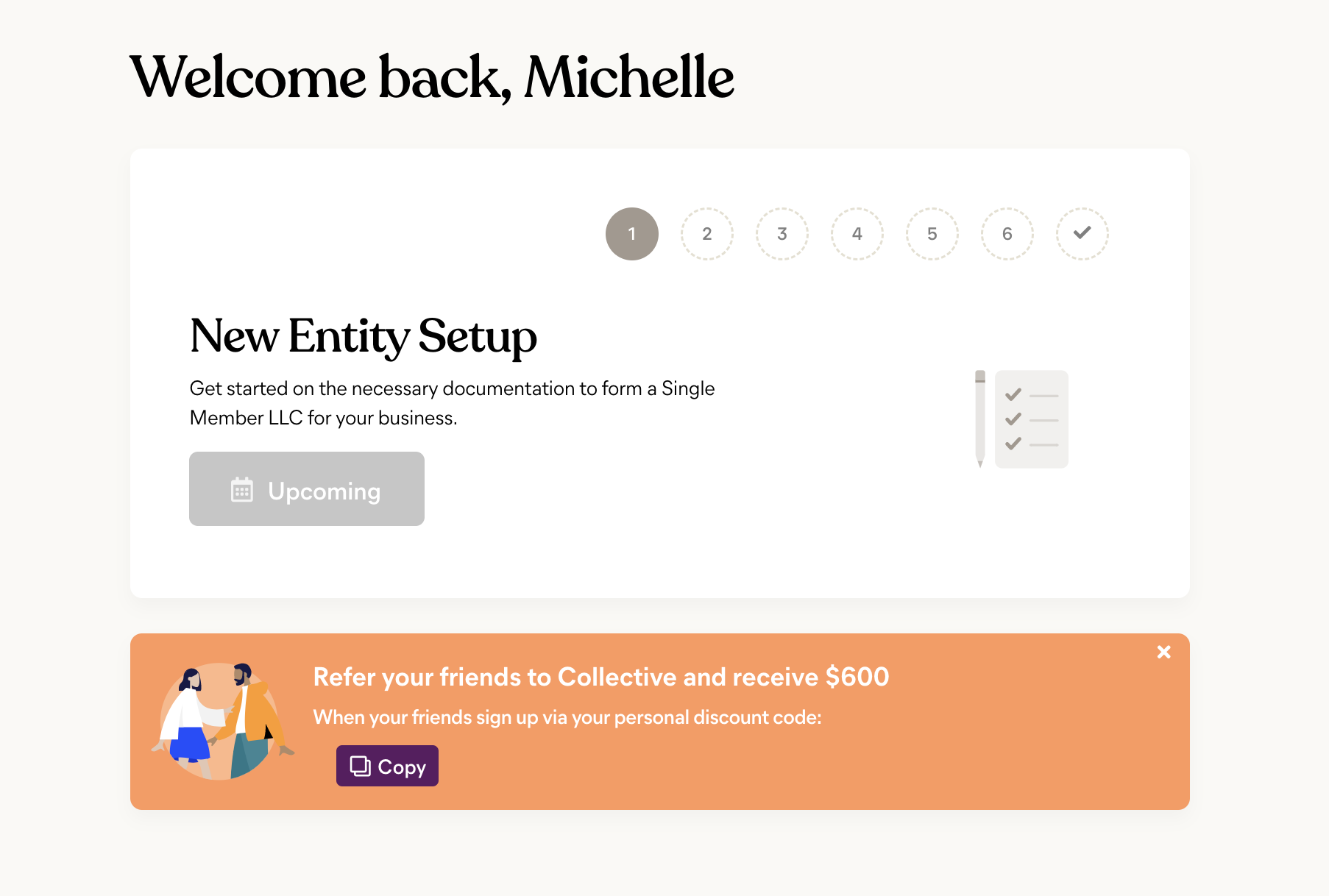

If you benefit from a client dashboard…Collective

I love being able to see upcoming meetings and tasks right in my client dashboard, which keeps everyone on the same page! It also prevents things from falling through the cracks - which I can be prone to do in my busy season when I’m juggling a million things at once!

Collective’s platform is designed with user-friendliness in mind and offers helpful tips for making better tax-savings decisions. Its features are intuitive and wonderfully interactive. I’m especially a huge fan of Collective’s reimbursements calculator, which allows me to accurately estimate my tax savings.

If you need meetings to be done in-person…Local CPA

Currently, Collective operates entirely online, which means meetings are conducted virtually. If you’re looking for a financial partner who can meet with you in-person, you will benefit more from a local CPA.

If you like transparent and affordable pricing …Collective

When I used a local CPA, I was paying close to $7,000-$8,000 per year for their bookkeeping and tax services, with 2-3 consultations included yearly, but payroll and other services were extra and billed hourly thereafter.

As you can imagine, I was thrilled when I learned that Collective offers me the same exact services - and more - at just $299 per month. And unlike a local CPA, payroll runs, bookkeeping, consultations, and business tax filing is all included in the cost!

The ultimate winner…Collective

The decision between utilizing Collective versus working with a local CPA ultimately boils down to personal preference and your unique situation. That said, after personally using both services, I found that Collective checks the boxes for everything I would have looked for in a CPA - and at a fraction of the cost.