When I first started my business I was unsure what type of expenses were deductible on my taxes or how I could calculate potential tax savings. I only knew how to be a wardrobe stylist and I didn’t know the “business” side. After much trial and error, I realized my first step should have been to check out Collective.

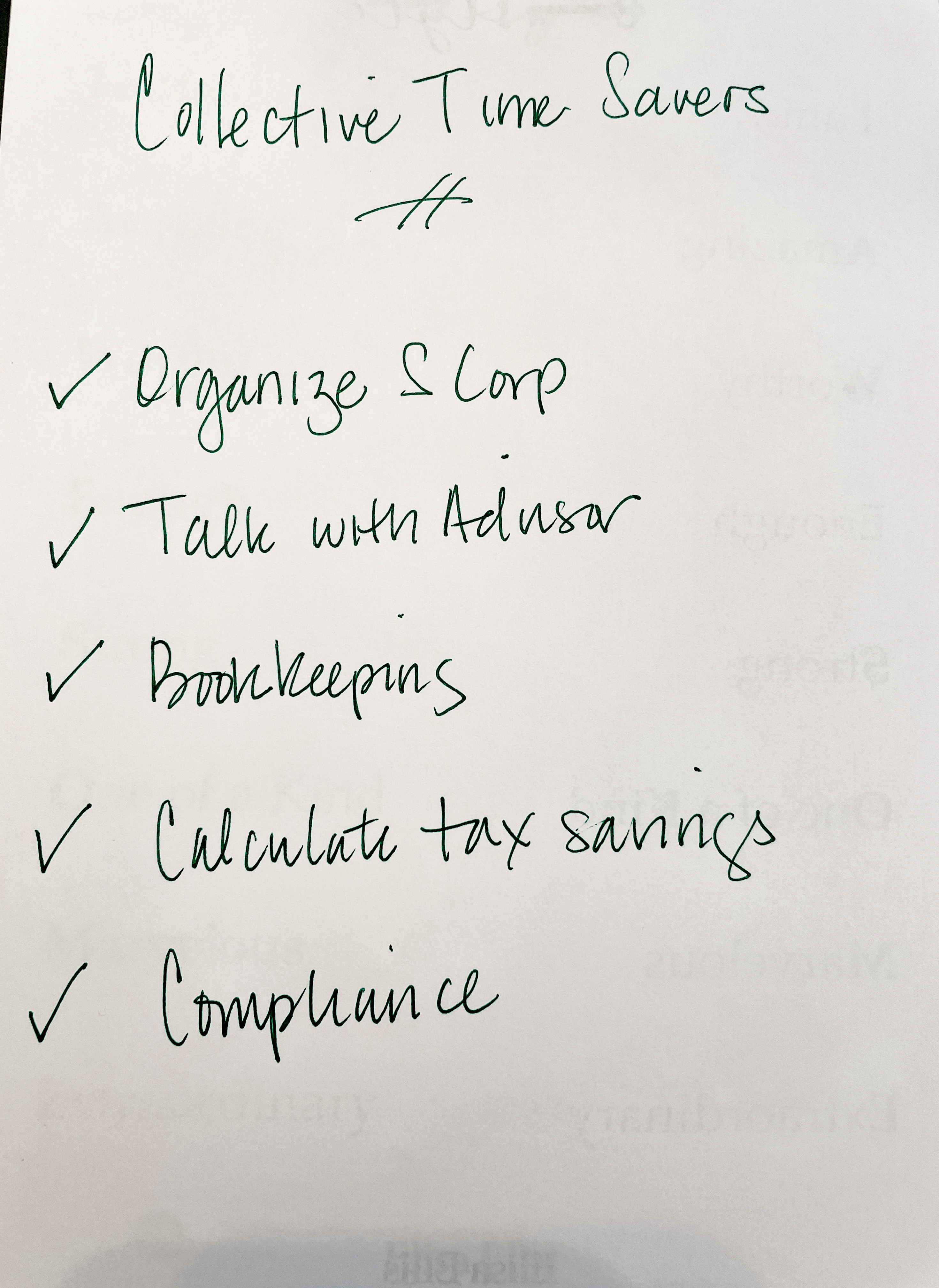

Collective has made it easy for me to identify and track all these tax deductions I could have been claiming all along. It’s truly an all-in-one financial solution for self-employed entrepreneurs. I get help with payroll, tracking expenses, bookkeeping, and accounting. I also found the consultation with a business advisor to be super valuable.

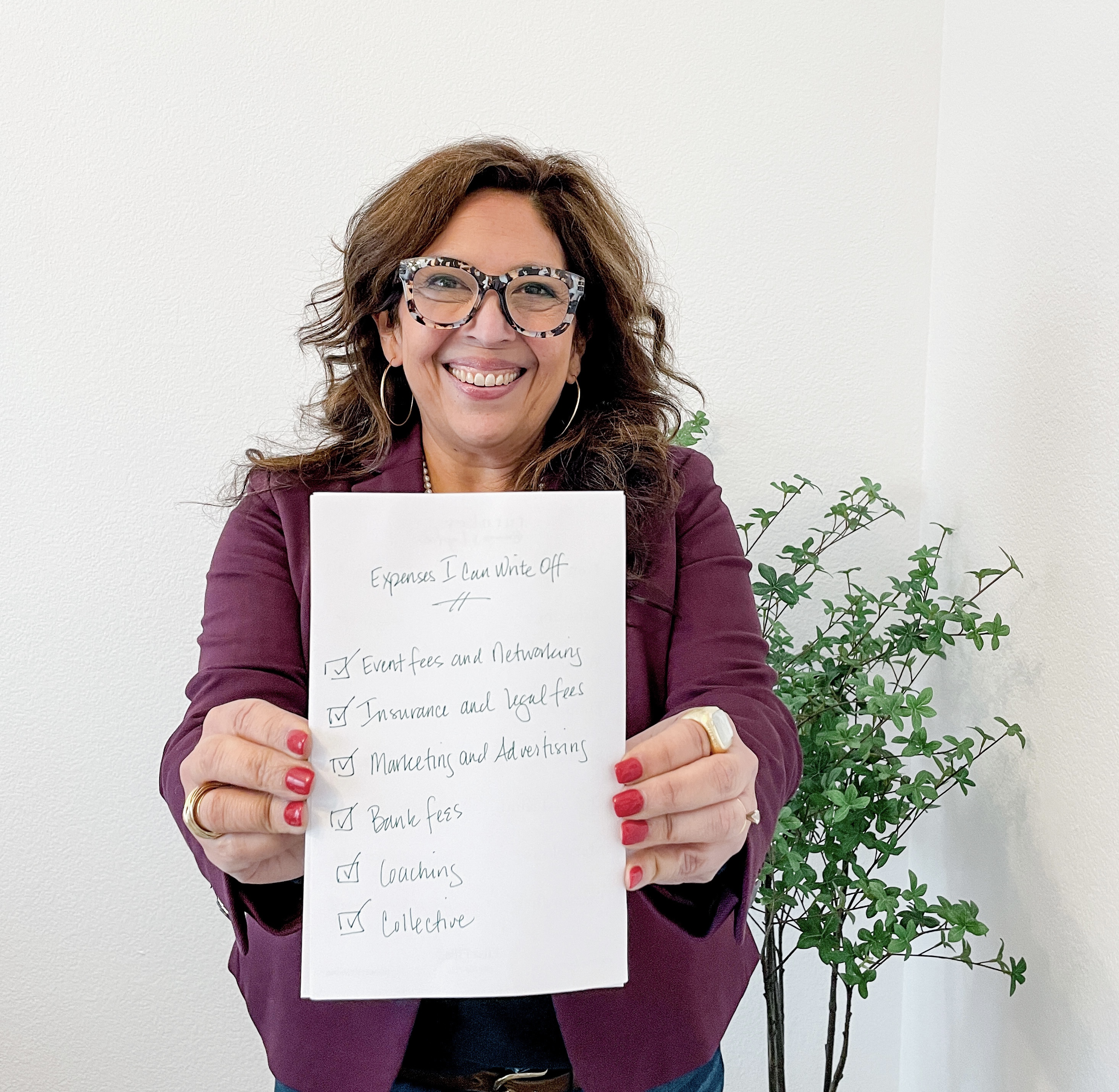

So, if you are thinking of starting a business, you might want to consider these five tax deductions that sole proprietors can write off on their taxes for maximum savings.

1. Event Fees and Networking

Going to events and networking is one of the top ways to generate referrals, meet with current and potential clients, generate new connections, and find new speaking engagements. I attend 4-6 different events and networking groups in any given month, which can really add up to a lot of expenses. So it puts my mind at ease to know that the event fees, recurring memberships, meals, and travel to and from these events can be deducted.

2. Home Office Space

If you have a dedicated workspace that’s separate from the rest of your home, you can claim it as a self-employed expense. This only works if you only use that space for your business but even so, you may be able to claim part of your internet bill as an expense if you work from home. With Collective, you can calculate the percentage of time spent on business activities and deduct that percentage amount from your internet bill. The same method applies for deductions on cell phone bills. Having the ability to track these expenses on Collective was super helpful.

3. Marketing and Advertising

This category can include a subscription to an email marketing service, a paid post shared on Instagram, or a flyer created for an event to promote business. Having Collective to help me navigate and easily track these expenses keeps me organized.

4. Travel expenses

Did you know that using your car to travel for business-related purposes, say client meetings or site-specific client work, is tax-deductible? And if you’re traveling out of town for work, flights, bus tickets, and hotel stays also count as tax-deductible expenses. Meals on work trips should be taken into account as well. While I’m on the road, using Collective really helps streamline all these deductions.

5. Workshops and Coaching

Every year I challenge myself to grow my business a little bit more and I could not do it without my business coaching. I also try to take advantage of in-person and online courses that help me gain new knowledge about my business and the changing platforms.

The Takeaway

These are only a few of the many business deductions that freelancers can take. Yes, it’s slightly overwhelming but Collective’s tax experts have helped me keep track of all these potential deductions on their easy-to-use platform. I have been able to save thousands every year because of Collective’s help and they can do the same for your business-of-one.