The holiday season is right around the corner, which means it’s time to start planning for flights, rental cars, and cozy stays. But for anyone with low credit or no credit at all, making those plans can quickly spiral into stress: higher fees, denied bookings, and missed opportunities.

Here’s my hack for a smooth holiday season: Kikoff, the credit-builder app that empowers users to boost their credit in time to book travel without the usual worries.

If you’ve ever found yourself scrambling to find a travel-friendly card or settling for last-minute, overpriced bookings, this one’s for you. With Kikoff, I took charge of my credit, scored better deals, and even found myself enjoying the journey as much as the destination. Here are 4 reasons Kikoff is the best gift you can give yourself (and your wallet) this holiday season:

Credit, Get it? Get Approved Faster for Travel Essentials

Take it from me: low credit can totally throw a wrench into travel plans. From booking a rental car to reserving a hotel room, many companies run credit checks or require hefty deposits if your credit score is below average.

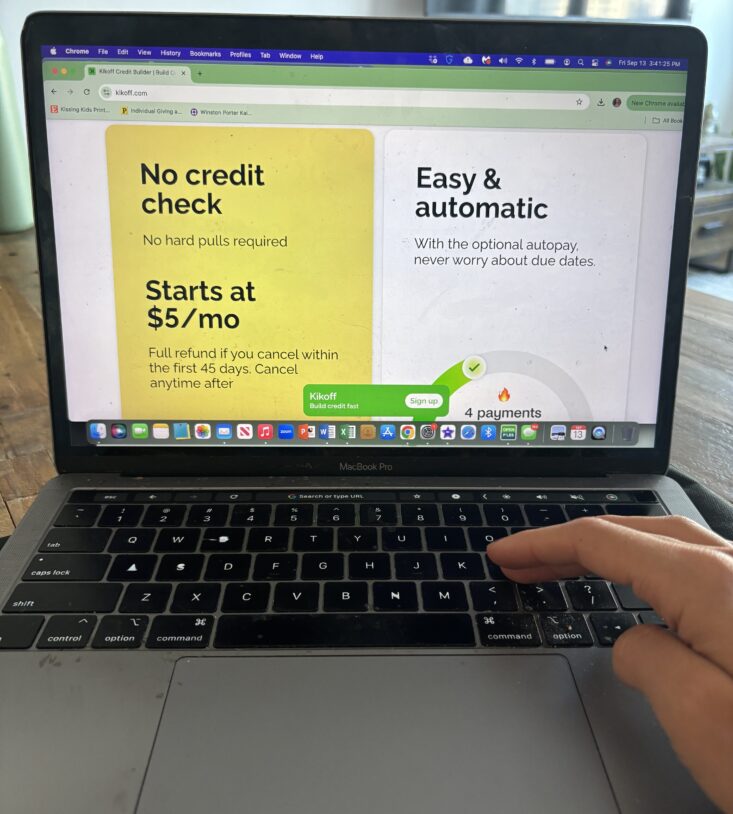

That’s where Kikoff comes in. With plans starting at just $5 a month, Kikoff reports to all three major credit bureaus, helping you build a solid credit history quickly.

When I started with Kikoff Basic, I saw a 28-point increase in my credit score within the first month. By the time the holidays rolled around, I was ready to breeze through reservations without worrying about extra fees or denials. It’s a no-brainer for anyone who wants to avoid surprises at the check-in counter.

Street Cred: No Interest, No Hidden Fees—Just your Credit

Many credit-building tools come with strings attached: hidden fees, high interest rates, or confusing terms. Kikoff is refreshingly straightforward. Whether you choose the $5/month Basic plan or the $20/month Premium plan, there are no credit checks, no interest, and no surprise charges.

Kikoff reports to the credit bureaus, so every month can help boost my credit. For me, that simplicity was key. I knew I was improving my credit without adding financial stress during an already expensive season. It’s like having a financial safety net, especially when big holiday expenses loom ahead.

Credit Edit: Build Credit with Rent Payments and More

One of my favorite features of Kikoff Premium is rent reporting. For just $20 a month, Kikoff helps you build credit with the rent you’re already paying—a feature I wish I’d known about sooner! With Premium, I also got access to free credit reports and monitoring, so I could track my progress in real-time.

This feature was a huge help for my holiday prep. Not only did my score jump by 51 points in my first year, but I also felt more confident booking flights and stays when it was time to travel. It’s incredible how much peace of mind comes from seeing your credit score climb while going about your usual routine. Dollars and sense!

CredHeads Unite: Expert-engineered financial freedom

Kikoff isn’t just a convenient app; it’s also one of the most trusted names in credit-building. Featured in Credit Karma, NerdWallet, and CNBC, Kikoff has earned its reputation as a smart, effective way to grow credit without the scams or pitfalls of traditional credit repair services.

As someone who’s tried “quick-fix” solutions before (spoiler alert: they didn’t work), I was skeptical at first. But Kikoff delivered results. For the first time in years, I didn’t dread checking my credit score before making holiday plans. Instead, I felt empowered to book what I wanted, knowing I’d worked hard to improve my financial standing.

Extra Credit: Work Smarter, Not Harder with Kikoff

Whether you’re dreaming of snow-covered getaways or sunny escapes, don’t let low credit hold you back this holiday season. Kikoff makes it easy to build credit on your terms—with no interest, no credit checks, and plans starting at just $5 a month.