So there I was, sitting in my car at 10 p.m. on a Thursday, staring at my gas light like it was the final boss in a video game. Two more deliveries to go, tank basically running on hopes and vibes. Payday? Not until Monday. I was about to play “which bill can wait this week?” (my least favorite game) when I remembered I had Current. After filling out a quick form, boom: advance1 unlocked, gas tank filled, crisis averted.

I’ve been dashing full-time a while now. The flexibility’s great, tips are decent most days, but money’s still tight. That’s the part no one glamorizes on TikTok. Bills show up whenever they want, gas prices spike like they’re on roller coasters, and rent stays ridiculously high. Thankfully, I found Current1, and it’s been a total game-changer. Here’s why:

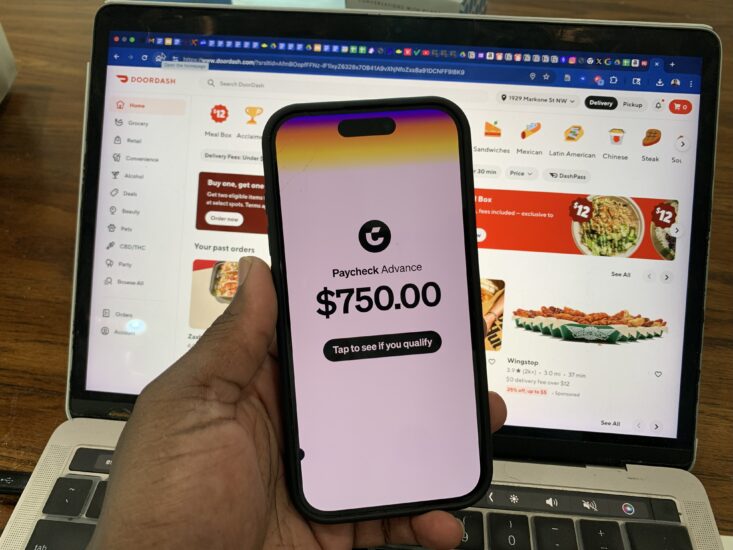

1. Paycheck Advance2 Up to $750 (aka “Gas Tank God Mode”)

One thing about gig life: you earn the money, but getting access to it can feel like waiting for the next season of your favorite Netflix show. With Current’s Paycheck Advance2 (for eligible customers only), you can get up to $750 early. No credit check, no drama.

The first time I used it, I needed groceries and gas before a big weekend of dashing. Normally I’d be stuck choosing between ramen noodles or Ubering myself to my deliveries (which makes zero sense). But instead, I grabbed an advance through Current and hit the road fully fueled literally and financially.

Think of it like unlocking “early access” to your own paycheck2. The money’s already yours, Current just lets you use it sooner.

2. Fee-Free Overdraft3 = My “Oops” Protection Plan

You ever swipe your card at the gas station and pray like it’s a lottery ticket? Yeah, me too. Except with Current, even if I’m short, I’ve got fee-free overdraft coverage3 up to $200 (once you qualify). That means I can cover the essentials without getting smacked with those “surprise, here’s a $35 fee for being broke” charges.

Last week, my phone bill hit $60 more than I expected. Old me would’ve been spiraling, imagining my service cut off mid-delivery while my customer’s Chipotle sat in the passenger seat. But Current had my back. It covered it, no stress, and I paid it back after payout. Fee-free overdraft3 feels like having a friend spot you some cash without the awkward “I’ll pay you back Friday” text.

3. Smarter Money Management Because Gig Work Isn’t Math Class

Some days, I make bank. Other days… let’s just say I basically pay for gas and a Gatorade. That kind of income roller coaster makes planning almost impossible. Current smooths all of that out. I can see where my money’s going, track my spending, and avoid the panic spiral of “did my Netflix auto-renew or am I really this broke?”

The best part? It’s not some dusty old bank app. It feels like it was actually built for people like us: people who need their money fast, flexible, and in one place we can manage from our phones. No spreadsheets, no complicated math, just clear answers so I can focus on what matters: making deliveries and maybe sneaking in a drive-thru snack between orders.

The Bottom Line

As a Dasher, my job is to bring people what they want. Current makes sure I can get the money I need, when I need it.

It gives advances2, overdraft coverage3, and peace of mind. I never have to worry that my finances are going to pull a plot twist on me. For me, it’s meant never missing a busy weekend because of an empty tank, never stressing over random fees, and finally feeling like my money flow matches the hustle.

If you’re out here grinding (dashing, shopping, delivering, whatever), Current is the move. Download it, link your deposits, and give yourself that head start. Because let’s be real: your gas tank deserves better than “hope and vibes.”

- Current is a financial technology company, not an FDIC-insured bank. FDIC insurance up to $250,000 only covers the failure of an FDIC-insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. Banking services provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC. The Current Visa® Debit Card is issued by Choice Financial Group pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. The Current Visa® secured charge card is issued by Cross River Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see the back of your Card for its issuing bank. Current Individual Account required to apply for the Current Visa® secured charge card. Independent approval required.

- For eligible customers only. Your actual available Paycheck Advance amount will be displayed to you in the mobile app and may change from time to time. Conditions and eligibility may vary and are subject to change at any time, at the sole discretion of Finco Advance LLC, which offers this optional feature. Finco Advance LLC is a financial technology company, not a bank. For more information, please refer to Paycheck Advance Terms and Conditions.

- Actual overdraft amount may vary and is subject to change at any time, at Current’s sole discretion. In order to qualify and enroll in the Fee-Free Overdraft feature, you must receive $500 or more in Eligible Direct Deposits into your Current Account over the preceding 35-day period and fulfill other requirements subject to Current’s discretion. Negative balances must be repaid within 60 days of the first Eligible Transaction that caused the negative balance. For more information, please refer to Fee-free Overdraft Terms and Conditions (https://current.com/overdraft_protection_terms_of_service/). Individual Current Accounts only.